Should I Buy Now or Wait Until Spring 2023?

With so much being written about the real estate market, and the effect of rising interest rates on future availability and affordability, many buyers are wondering "Should I buy now or wait until Spring 2023?". So, let's look at the real estate market data to help you decide.

For Spring 2023 to be a "better time to buy" we need one (or more) of the following to be true.

1. It will be easier to buy in 2023 because there will be less buyers.

2. It will be easier to buy in 2023 because there will be more sellers.

3. Prices will be lower in 2023 than they are today.

4. Interest rates will be lower in 2023.

Let's look at each of these.

Less Buyers?

Will there be more buyers looking for homes in Spring 2023? Let's start by looking at a metric that identifies buyer numbers and confidence - the Sale Price/List Price Ratio. This is the ratio of the original list price (before any price adjustments) and the final sale price. A ratio over 100% means that multiple buyers competed for the home driving its final sale price over the asking price.

This ratio has risen dramatically in 2021 and 2022 indicative of a high number of buyers and a high level of buyer confidence. But, the question is, what has been the effect of rising interest rates on this metric? Here's the sale price to list price ratio plotted by month (the orange line). The ratio is plotted based on the sale date - but, remember, its typically 4-6-8 weeks from a home going under agreement (buyers deciding to buy) and closing (buyers actually getting the keys). So, this is a lagging indicator.

We have definitely seen a reduction in this ratio over the past 3 months. But it's important to look at the absolute number. The sale price to list price ratio is still over 100% for both Arlington and Lexington - this means multiple buyers are competing for homes. Remember also, that as we progress through the year many buyers have already bought and so there is less competition from other buyers and so a slight reduction in this metric is not uncommon as the year progresses.

For Sold/List Price Ratio data for other towns in our datawarehouse see: Sold/List Price Ratio

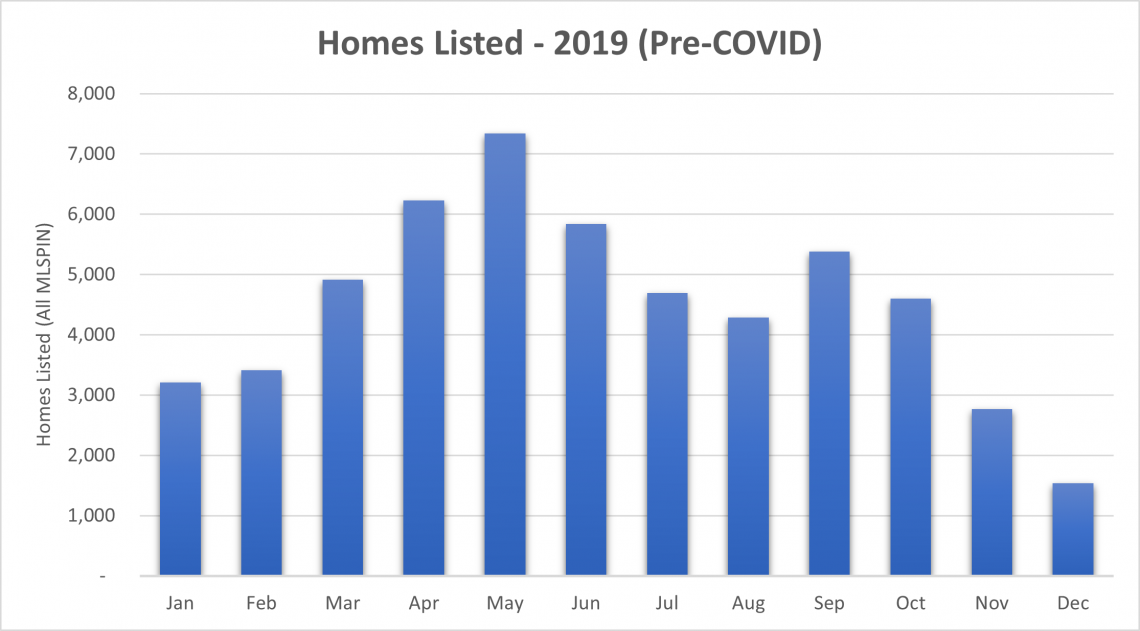

One other thing to note in this data is that the sale price to list price ratio is at its highest, and competition is typically at its peak, early in the year. The reason is the seasonality in the real estate market. There are two key seasons - Spring (March - June) and Fall (September-October). Approximately 45% of homes are listed in the Spring market, only 20% are listed in the short Fall market. But, Spring is where competition is at its most intense as every year a new group of renters/relocators/move up buyers etc. enter the market.

This typical seasonality, with a new set of buyers entering the market, has occurred year after year since 2013 when the market rebounded from the real estate 'crash'. There is no indication in the data that tells us that there will be less buyers in 2023 - entirely the opposite as typically a new set of buyers (and 2022 unsuccessful buyers) will be out in force once the winter weather breaks.

More Sellers?

Will there be more sellers in the market in Spring 2023? We definitely saw an increase in the number of sellers in 2020 and 2021. The reason this occurred was COVID. Many home owners felt that the home they were currently in did not meet the changing requirements brought about by hybrid work patterns, home schooling and a different perspective on the "value" of home and home life. In addition, many down-sizers decided to take advantage of record high prices to sell their larger home and move into a smaller home, or to a different part of the country/world. And so, we saw a large increase in the number of homes available for sale, and subsequently sold, in 2020 and 2021.

Eventually this COVID effect will work itself out and we will return to the normal levels. We can see this happening in a number of town. Here's the Yearly Total Sales data for Lexington. The number of homes available for sale in 2022 are returning to the levels seen in 2018/2019.

The increase in homes sales was delayed by 12 months in a number of towns - see Arlington Yearly Total Sales data below. Based on prior historical data in these towns, these will follow the trends and return to normal home sale levels in 2023.

So, even though we have seen an increase in the number of homes sales in recent years this was a consequence of changing housing requirements brought about by COVID. These have largely worked through the system and supply of homes for sale, and subsequently selling, are now returning to normal (pre-COVID) for almost all towns by 2023.

For Yearly Total Sales data for additional towns see: Yearly Total Sales

Lower Prices?

Will home prices reduce in 2023? Looking at average home prices since 2001 the only time we have seen depreciating home prices was during the housing market crash in 2009. Even this reduction was somewhat skewed by the first-time home buyer tax credit in 2009 which meant there were more first time home buyers in the market, and there were more affordable homes sold, thus skewing the average sale price data lower. Since that time we have seen positive price appreciation.

Economics 101 - in order for prices to depreciate (go down from where they are today) there needs to be less demand (less buyers) AND increased supply (more sellers). As we've explained above neither of these situations seems likely and price depreciation NEEDS both to exist for that to happen.

Look closely at the monthly data (the green bars) - the average sales prices on a month by month basis are at their highest in the Spring market where the number of buyers is at its largest. This shows us that waiting to buy until Spring 2023 will mean that competition will increase, and prices will be higher than what they are in Fall 2022.

For Average Homes Prices in additional towns see: Average Home Prices

If you're looking for Median Home Price data we have that also: Median Home Prices

Lower Mortgage Interest Rates?

Predicting mortgage interest rates is always a risky game. We've seen this year after year that predictions on what is going to happen to mortgage interest rates rarely gets it right. What's clear though is that the Federal Reserve's strategy of higher overall interest rates in order to curb price inflation is an on-going process. Also, the increases in interest rates we have seen so far in 2022 have pushed mortgage interest rate to the highest level we've seen in over a decade. What we are seeing buyers do these days, is to finance using ARM's (Adjustable Rate Mortgages) which typically have an interest rate lower than the 30-year fixed rates, with the intention of refinancing when 30-year fixed rates fall (if/when they do).

Here's the historic interest rates. Source: Freddie Mac Mortgage Rate Survey

Here is a graph of the 30 year fixed mortgage interest rates since 2009 up until mid 2022, and the predictions for the 30-year fixed mortgage interest through to the end of 2023. The mortgage interest rate forecast (green) is the Mortgage Banker Association forecast. Source: Forecasts and Commentary.

If these forecasts of what the 30-year fixed mortgage interest rates holds true we will not see an appreciable drop in mortgage interest rates until 2024, and even this is highly dependent on the Federal Reserve's efforts to curb overall price inflation by 2024.

Should Buyers Wait Until Spring 2023?

Will it be easier to buy in 2023 because there will be less buyers?

Based on historic trends we do not expect there to be less buyers in Spring 2023.

Will it be easier to buy in 2023 because there will be more sellers?

Based on historic trends we do not anticipate more sellers in 2023.

Will home prices be lower in Spring 2023 than they are today?

With no reduction in the number of buyers, and no increase in the number of sellers, price appreciation may moderate but there will be no significant decrease in home prices.

Will mortgage interest rates be lower in 2023?

Based on the mortgage predictions by analysts it seems unlikely that we will see a significant reduction in mortgage interest rates until at least 2024.

To answer the question 'Should buyers delay buying until Spring 2023?', the answer, based on the data, is

'No, don't wait until Spring 2023 to buy as it seems unlikely that prices will be lower.'

For much more data showing what is happening in our local markets, for approx 50 different towns, see Real Estate Statistics on the MA Properties website.

What's Going on

With My Home's Value?

If you're wondering how real estate activity over the last two years has impacted your home's value, click below to get started with your free evaluation.