Summary

If 2022 was a “game of two halves” 2023 offered an overtime with more of the same. 2023 was impacted by rising mortgage interest rates – this caused sellers to postpone moving and buyers to pull back as they saw rates rise between getting a pre-approval and getting an accepted offer on a home. In some instances, this increase in borrowing costs caused buyers to exit contracts as repayment costs were simply too high.

Looking back at our 2022/2023 Market Review our two key predictions for 2023 were firstly the normal cycle of downsizing, move-up, and relocating sellers will continue with similar number of homes sales as we saw in 2022, and secondly, there is some hesitancy with buyers with mortgage rates still over 6% and uncertainty over the medium-term market condition and price appreciation. This hesitancy will subside as mortgage interest rates decline as the year unfolds.

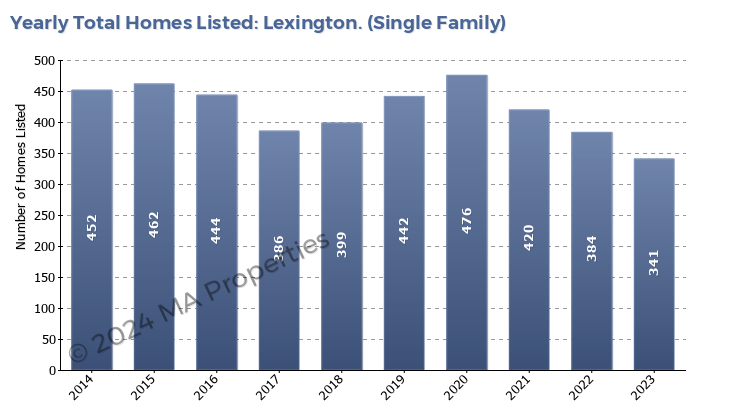

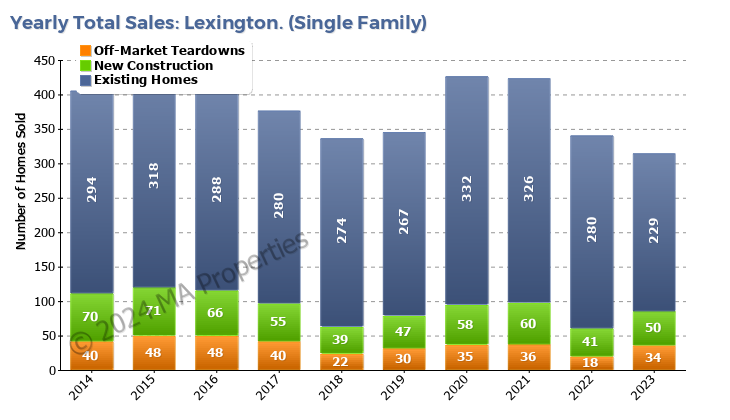

The continued high interest rates negatively impacted both predictions. The total number of homes sales in 2023 was lower than in 2022 as sellers postponed selling to avoid a large increase in their mortgage monthly repayments. The second prediction hinged on reduced interest rates as 2023 unfolded. The anticipated reduction did not occur until Q4 2023 and so had minimal impact on the overall 2023 housing market.

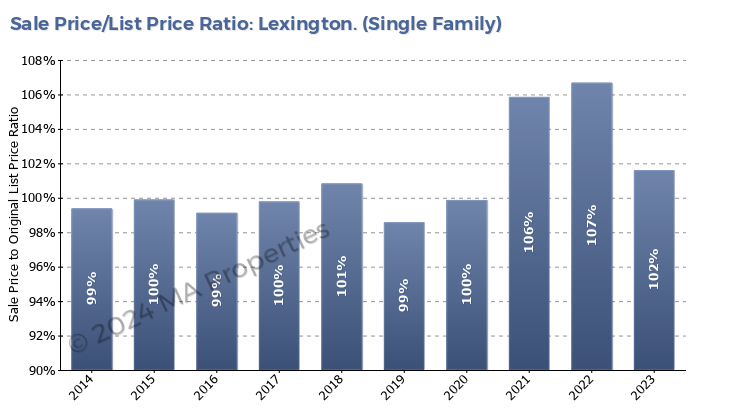

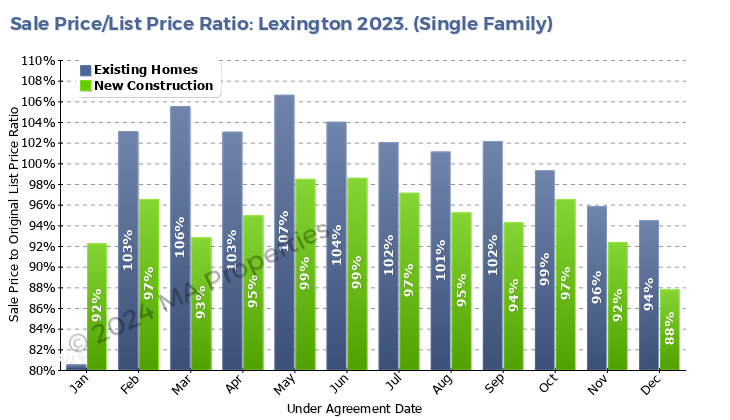

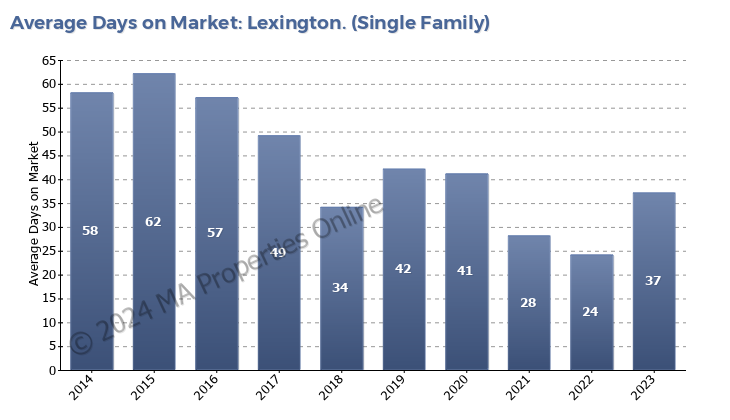

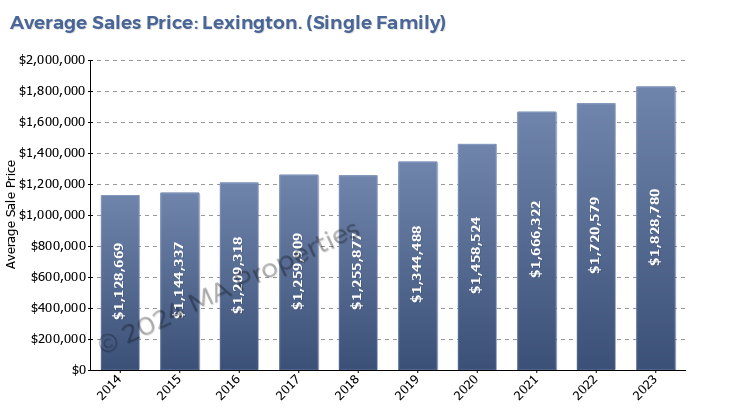

Given these characteristics many of the key performance metrics – days on the market and sale price/list price ratio - showed a relatively weak market in 2023. But closer examination shows a noticeable decline in these metrics as the second half of the year unfolded and the prospects of a substantial mortgage rate reduction declined. The sale price/list price ratio peaked at 106% in May (it was 116% in May 2022) and was at 102% for the full year, but it was at about 100% per month throughout the second half of the year.

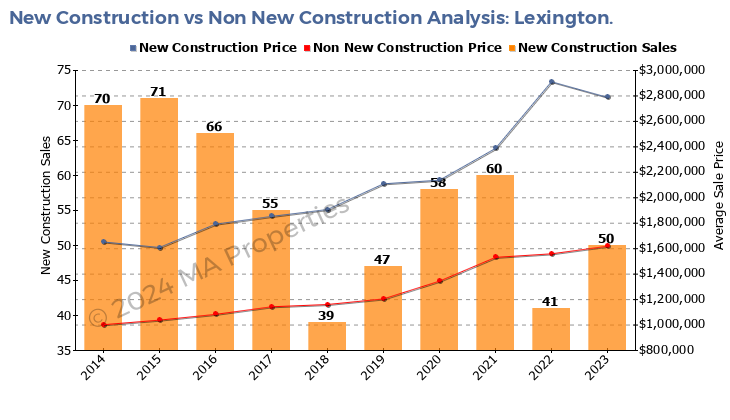

How should we view these numbers? Home sales were lower than anticipated but are on track to revert to 2018/2019 levels (as anticipated with the decline of the COVID effect). A 100% sales price/list price ratio was the value seen through each year from 2013-2020 and the 2023 value of 102% reinforces the prospect of a reversion to 2018/2019 market conditions. Days on the market were consistent throughout the year at about 37 days (2022 value was 24 days). And so, if we view these against the gloom and doom of the national real estate market it’s clear that the Lexington market weathered the market turmoil caused by the rapid rise in mortgage interest rates well. Proving that the adage ‘Real Estate is local’ is accurate.

As we look forward what will 2024 bring? Mortgage interest rates are moving downwards with 6.1% predicted by the end of the year and so with more sellers and less hesitant buyers we predict that the overall housing market will revert to the stable market condition seen prior to the COVID years of 2020 and 2021.