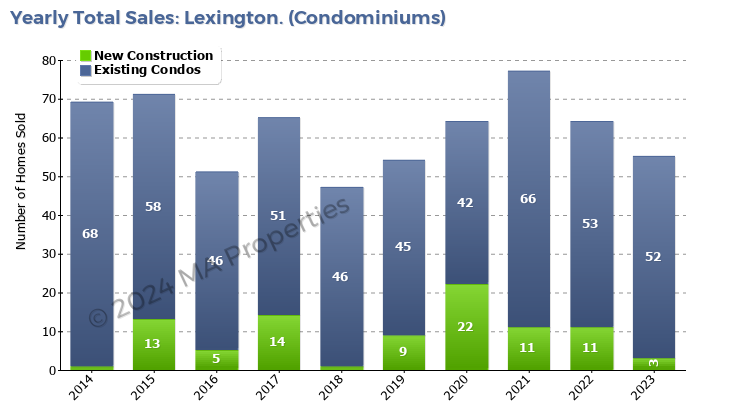

Condominiums Listed

The number of condominiums listed in 2023 was 56 compared to 71 in 2022. The difference can be explained because there were very few new construction condominiums listed in 2023 and the Lilly Pond Lane new construction project completed in 2022. Given that the single-family market saw an 11% reduction in homes listed due to sellers postponing their sale, we can see that condominium sellers continued to list. One reason for this is perhaps that condominiums are often seen as a steppingstone to a single-family home and the reduced living area of the condominium compared to single family homes forced many homeowners to move as the home no longer met their requirements.