Platform

Home > Communities > Arlington > Arlington Market Review > Single Family Home Market Summary

Summary

If 2022 was a “game of two halves” 2023 offered an overtime with more of the same. 2023 was impacted by rising mortgage interest rates – this caused sellers to postpone moving and buyers to pull back as they saw rates rise between getting a pre-approval and getting an accepted offer on a home. In some instances, this increase in borrowing costs caused buyers to exit contracts as repayment costs were simply too high.

Looking back at our 2022/2023 Market Review our two key predictions for 2023 were firstly the normal cycle of downsizing, move-up, and relocating sellers will continue with similar number of homes sales as we saw in 2022, and secondly, there is some hesitancy with buyers with mortgage rates still over 6% and uncertainty over the medium-term market condition and price appreciation. This hesitancy will subside as mortgage interest rates decline as the year unfolds.

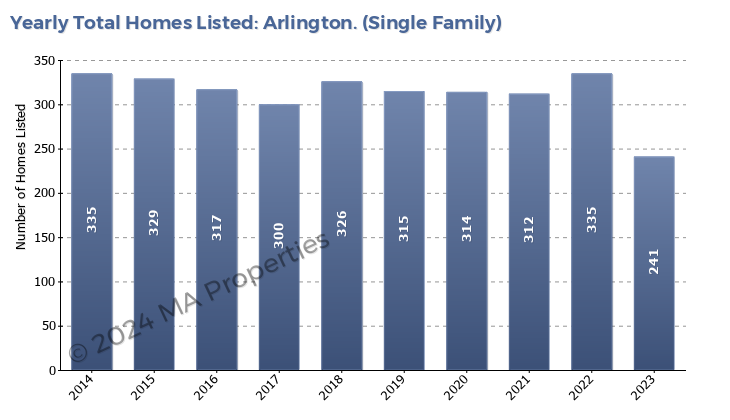

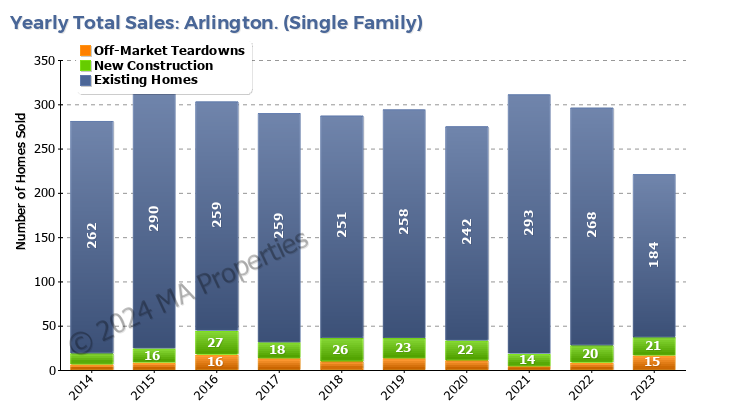

The continued high interest rates negatively impacted both predictions. The total number of homes sales in 2023 was lower than in 2022 as sellers postponed selling to avoid a large increase in their mortgage monthly repayments. The second prediction hinged on reduced interest rates as 2023 unfolded. The anticipated reduction did not occur until Q4 2023 and so had minimal impact on the overall 2023 housing market.

As we look forward what will 2024 bring? Mortgage interest rates are moving downwards with 6.1% predicted by the end of the year and so with more sellers and less hesitant buyers we predict that the overall housing market will revert to the stable market condition seen prior to the COVID years of 2020 and 2021.

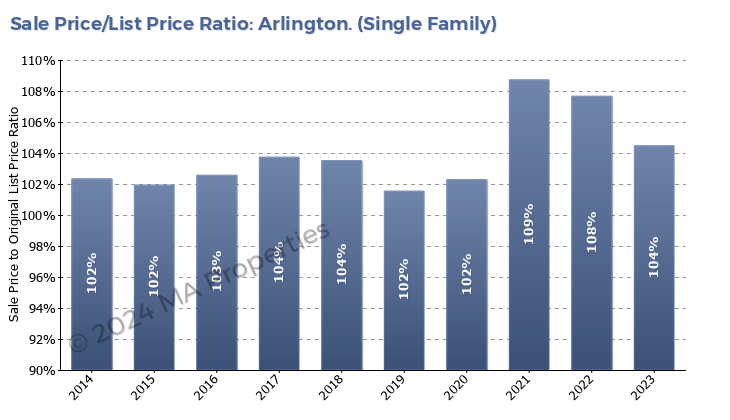

Sellers

It is a more challenging picture for sellers than we have seen in recent years. A decrease in supply usually means that buyers compete for homes creating a strong seller’s market. But 2023 saw very hesitant buyers in the market because of high interest rates combined with the high price appreciation seen in 2020 and 2021. But, with declining interest rates set to continue throughout 2024 we anticipate more sellers entering the market as they decide to “get off the fence” and move, chasing interest rates down (through refinancing). With the increasing number of sellers competition will increase and so, to get the maximum price for your home sellers need to focus on the fundamentals when selling – ‘move in’ ready, great staging, a comprehensive marketing strategy (utilizing both digital and traditional channels), and the right pricing strategy to attract the buyers who are looking to buy.

Buyers

While not as strong a sellers’ market as we have seen in prior years, the housing market in Arlington will continue to be challenging for buyers. The market will be characterized by moderate inventory, similar price levels to 2023, and relatively high mortgage interest rates. So, when the right opportunity arises, buyers must be prepared to act quickly and decisively. It is key to work with an agent who both understands and can educate you on the Arlington market, provide advice on the pros and cons of the home and resale potential of the home, and is able to assist you in structuring a competitive offer.

Homes Sold

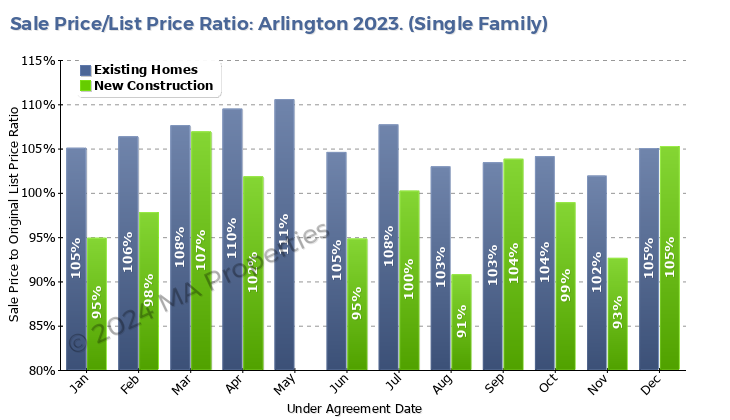

Sale Price to List Price Ratio

Sale Price to List Price Ratio (Monthly/NC)

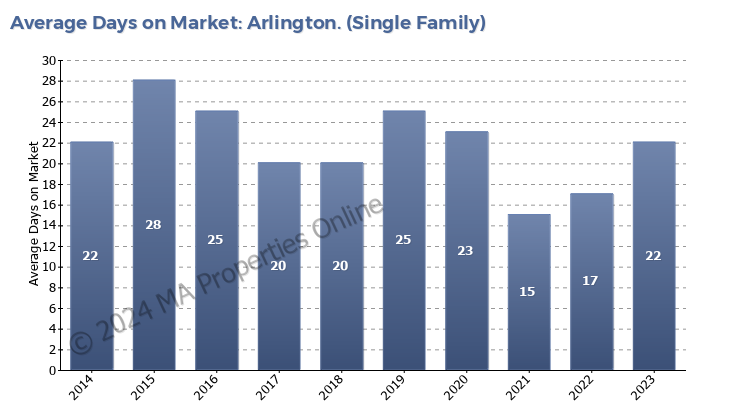

Average Days on Market

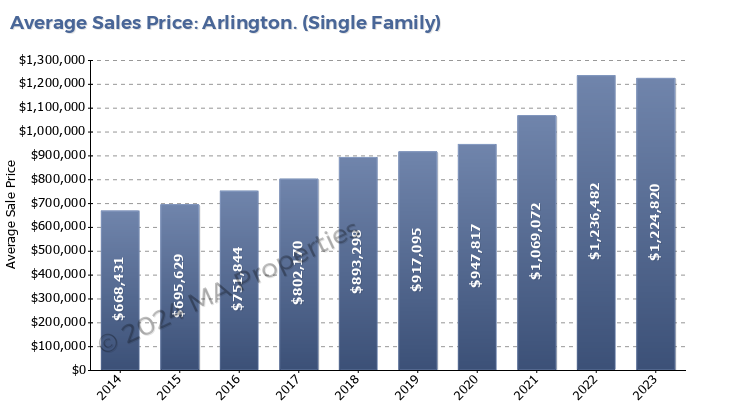

Average Sale Price

Sale Price Analysis